Setting up WooCommerce payment gateways can be overwhelming. There are multiple options available at various price points, and narrowing down your choices could leave you waving the white flag.

Setting up WooCommerce payment gateways can be overwhelming. There are multiple options available at various price points, and narrowing down your choices could leave you waving the white flag.

In this article, we’ll explain how WooCommerce payment gateways work, run through the features you need, discuss the difference between free and premium options, and explain how to integrate them into your setup.

WooCommerce Payment Options

WooCommerce is a WordPress plugin that enables you to set up an eCommerce store, and lets you manage products, orders, and even coupons from your dashboard. However, for various reasons, accepting online payments requires additional resources called payment gateways. Without one, you can only take cash or checks.

A WooCommerce payment gateway is a direct channel connecting your store to your merchant account, and is required to process online payments. Of course, the available plugins will dictate which external merchant accounts will work within your online store.

The payment gateway and merchant account you choose also depends on where your business’ country and customers are based, along with the currencies you’d like to accept. While the merchant accounts may incur fees, the plugins themselves are often free (although some require payment).

Whatever the case, it is important to understand that without a payment gateway such as PayPal or Stripe, you won’t be able to accept online payments.

WooCommerce Credit Card Plugins

The most popular type of WooCommerce payment gateways may also be called credit card plugins. These are specifically designed to work with merchant accounts that specialize in credit card transactions.

Put simply, merchant accounts are specialized banking accounts that process credit cards on behalf of the businesses using it. This adds a layer of security by using a specialized third-party to validate and process every transaction. These merchant accounts can be set up to work with WooCommerce payment gateways.

First, WooCommerce generates the order a customer has requested. Next, the customer confirms the order and goes to pay, which triggers the payment gateway and makes a connection with the merchant account. The customer then enters their payment information, which is read by the merchant account. Finally, the merchant account processes all of the purchase data, and either accepts or declines the payment.

If a payment is accepted, the gateway triggers a ‘success pathway’ to deliver the order to the customer. The merchant account deducts money from the customer and credits it to the business’ account. All of this gets stored within WooCommerce, where you can access and manage your customer’s orders.

However, if payment is declined, the gateway notifies the customer that their order didn’t go through, and does not let them complete the order.

There are a number of elements you should consider when choosing a suitable plugin, such as:

- Security. Card information should be securely saved within your merchant account, rather than your local website.This helps ensure you’re not liable if your website is compromised.

- Cost. To ascertain whether a solution is financially viable for you, calculate the total monthly, annual, and one-time fees incurred. Of course, the cost should not outweigh the amount of income you expect to receive.

- Reliability. Not all plugins are backed by a reliable company or developer who can insure their reliability. That means your choice here is important. Fortunately, WooCommerce lists trusted plugin developers on its site.

- Flexible options. For small stores, you likely won’t need many options. However, you should always check that your desired features are supported by the payment system. For example, not all merchant accounts support recurring payments or subscriptions.

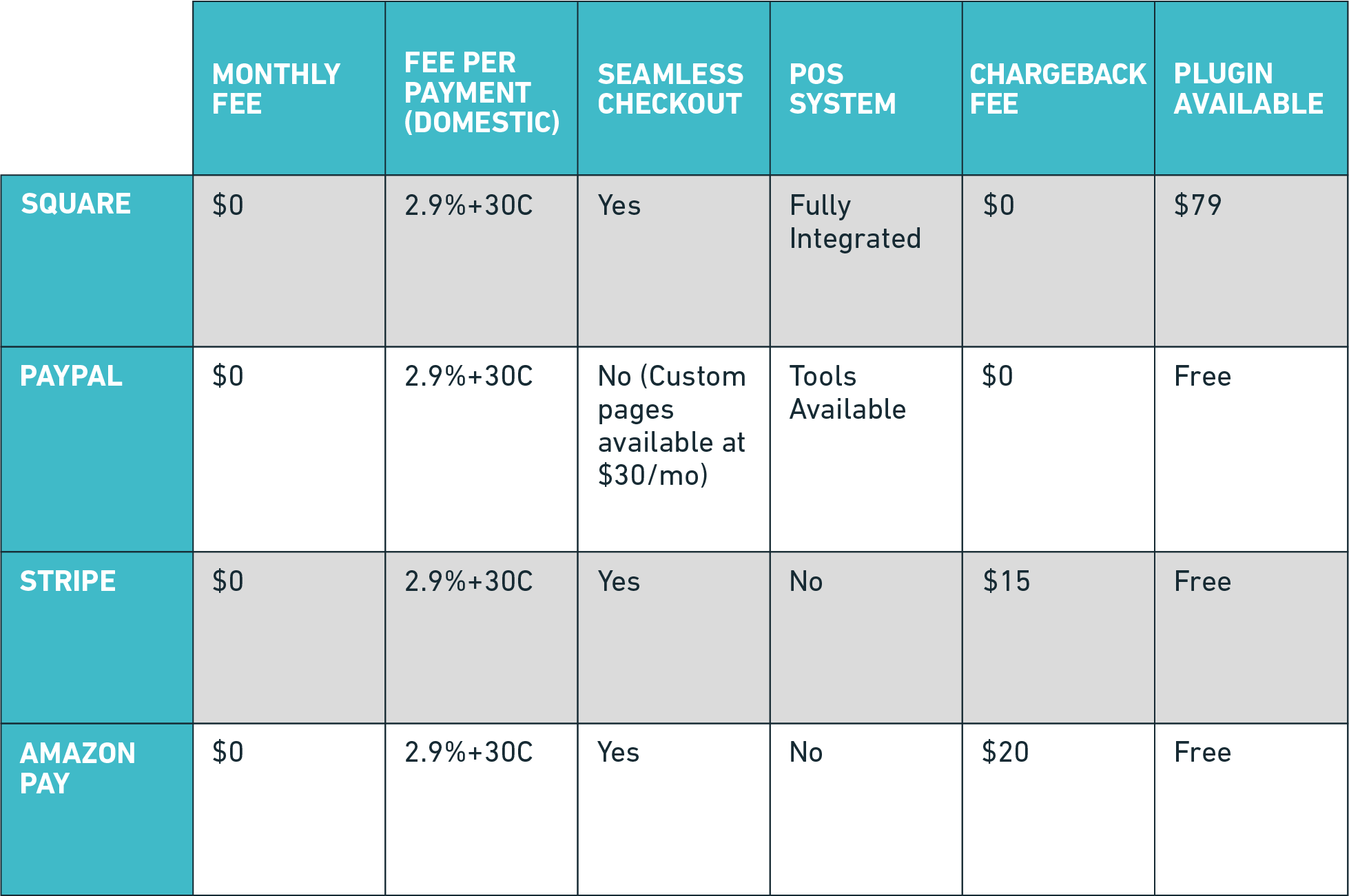

Coming back to the cost factor, each payment gateway will have different fees attached, and different prices for their respective plugins. To compare them, check out this table:

At this point, you’re ready to choose a gateway. However, whether you opt for a free or premium solution is an important consideration.

Free WooCommerce Payment Gateways vs. Premium

Whether you choose a free or premium option for your WooCommerce payment gateway, your choice will strongly depend on your business’ needs – and both have pros and cons.

A few popular payment gateway add-ons with free WooCommerce plugins include PayPal, Stripe, and Amazon Pay:

Free payment gateways are are usually quick and simple to use, without a lot of fancy choices, and will likely charge a small percentage per transaction. They also usually require users to leave your website to pay via a merchant account page. Free gateways are perfect if:

- You’re a new business with no cash flow yet.

- You want to experiment with WooCommerce without a lot of commitment.

- You’d like to try a new payment gateway with low risk.

If you want to have more control over the checkout process, premium accounts often offer on-page purchasing and more customization for extras such as confirmation emails. These are great if:

- You’re an established business and want to keep your branding intact through the entire payment process.

- You don’t want to send customers off-site and potentially impact sales.

- You have the budget for monthly or annual fees.

Each free and premium service differs in terms of features, ongoing costs, and incurred fees, so it’s up to you to research the best fit. Also, consider how WooCommerce will integrate with the other systems you use, and which customer cases are most typical for your business.

WooCommerce Payment Gateway Integrations

Adding a payment gateway means installing its associated WooCommerce plugin and adding your account information. While each plugin is different, integration usually follows the same process:

- For a free plugin, navigate to the Plugins > Add Plugin screen within WordPress, and search for it. For premium options, you may need to download the plugin’s .zip file directly from the developer.

- Follow the installation and activation procedure within WordPress, which will vary depending on the option you chose from step one.

- Follow the plugin’s provided instructions for configuration within WooCommerce.

The payment gateway integration will rely on your site being up to date, and you having an active merchant account properly associated within WooCommerce.

In addition, your site needs to respond quickly to any API calls made by the merchant account while it processes payments, so it’s important to have reliable hosting for your website.

WP Engine provides enterprise-quality WordPress hosting, with the versatility to handle almost any WooCommerce configuration you can dream of. Whether you’re running a small digital business or launching a new eCommerce platform for large-scale retail, WP Engine has a plan that suits your needs.